Wells Fargo Banking

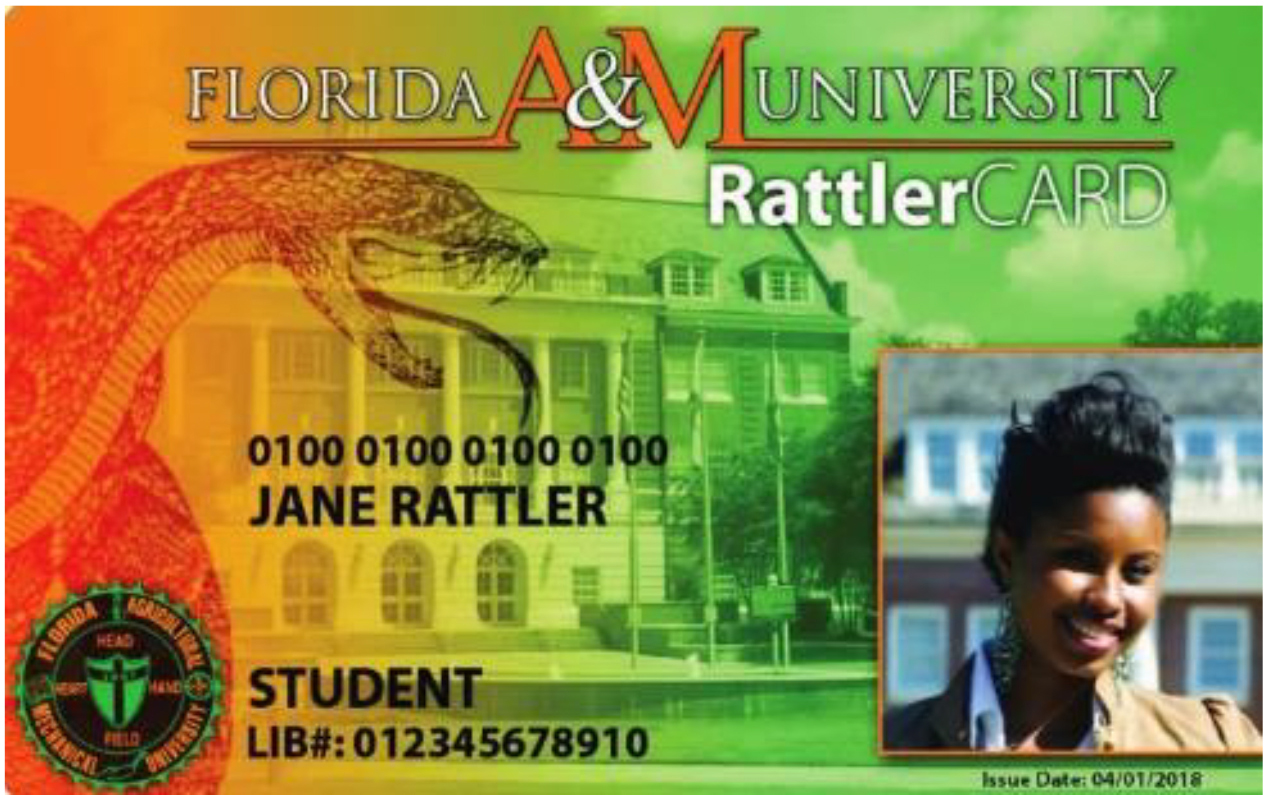

Florida A&M University and Wells Fargo have teamed up to offer you optional banking convenience with your linked FAMU Rattler Card.

Link it.

Link your FAMU Rattler Card when you open your Wells Fargo checking account at any Wells Fargo branch. Find a branch near you and schedule an appointment.

On campus or off, you’re ready.

- It’s your official student ID for campus privileges.

- Make purchases using your PIN.

- Access ATMs across the U.S., including no-fee cash access at Wells Fargo ATMs, including ATMs on campus.

- Use the Wells Fargo Mobile® app2 to check account activity, deposit checks3, transfer funds4, pay bills, send money with Zelle®5, and set up push notifications, text, or email alerts6.

-

On campus or off, you’re ready:

• It’s your official student ID for campus privileges.

• Make purchases using your PIN

• Access ATMs across the U.S., including no-fee cash access at Wells Fargo ATMs, including ATMs on campus. - Use the Wells Fargo Mobile® app2 to check account activity, deposit checks3, transfer funds4, pay bills, send money with Zelle®5, and set up push notifications, text, or email alerts6.

-

Link your FAMU Rattler Card to a Wells Fargo Clear Access Banking account for these exclusive benefits7 during each fee period:

• No monthly service fee charged. - No Wells Fargo fees for up to four cash withdrawals from non-Wells Fargo ATMs in the U.S.8

- Courtesy refund of one incoming wire transfer fee.9

-

Link your FAMU Rattler Card to an Everyday Checking account to receive the same benefits, as well as:

• No fee charged for one overdraft.10

Regulations

For information about the major feature and common fees of checking accounts offered through this program, please click on the links below:

The Department of Education’s (ED) Cash Management regulations 34 CFR 668.164(d)(4)(i)(B)(2) (issued October 2015), require institutions participating in T2 (Campus Card) arrangements to list and identify the major features and commonly assessed fees as well as a URL for the terms and conditions of each financial account offered under the arrangement.

2023 Financial Disclosure Form

Visit wellsfargo.com/famu for more details.

- The FAMU Rattler Card is an official school ID and a Wells Fargo Campus ATM Card when linked to a Wells Fargo checking account.

- Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply.

- Mobile deposit is only available through the Wells Fargo Mobile® app on eligible mobile devices. Deposit limits and other restrictions apply. Some accounts are not eligible for mobile deposit. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply. See Wells Fargo’s OnlineAccess Agreement and your applicable business account fee disclosures for other terms, conditions, and limitations.

- Terms and conditions apply. Setup is required for transfers to other U.S. financial institutions, and verification may take 1–3 business days. Customers should refer to their other U.S. financial institutions for information about any potential fees charged by those institutions. Mobile carrier’s message and data rates may apply. See Wells Fargo’s Online Access Agreement for more information.

- Enrollment with Zelle® through Wells Fargo Online® or Wells Fargo Business Online® is required. Terms and conditions apply. U.S. checking or savings account required to use Zelle®. Transactions between enrolled users typically occur in minutes. For your protection, Zelle® should only be used for sending money to friends, family, or others you trust. Neither Wells Fargo nor Zelle® offers purchase protection for payments made with Zelle® - for example, if you do not receive the item you paid for or the item is not as described or as you expected. Payment requests to persons not already enrolled with Zelle® must be sent to an email address. To send or receive money with a small business, both parties must be enrolled with Zelle® directly through their financial institution’s online or mobile banking experience. For more information, view the Zelle® Transfer Service Addendum to the Wells Fargo Online Access Agreement. Your mobile carrier’s message and data rates may apply. Account fees (e.g., monthly service, overdraft) may apply to Wells Fargo account(s) with which you use Zelle®.

- Sign- up may be required. Availability may be affected by your mobile carrier’s coverage area. Your mobile carrier’s message and data rates may apply. Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Wells Fargo may provide financial support to Florida A&M University for services associated with the FAMU Rattler Card.

Wells Fargo Bank, N.A. Member FDIC.

Florida A&M University is not an FDIC-insured depository institution; FDIC deposit insurance only protects against the failure of Wells Fargo Bank, N.A. Member FDIC

FDIC Third Party footnote statement

The FDIC recently issued a new regulation requiring third parties who are in arrangements with financial institutions, such as for a Campus Card program, to post a new updated statement that indicates the third party is not an FDIC-insured depository institution. This regulation takes effect January 1, 2025.

PLEASE NOTE: This statement must appear on every university-hosted page where there is a reference to the Wells Fargo Campus Card banking option and in no smaller than 8 point type following the copy about the program (generally located at the end of the page):

Florida A&M University is not an FDIC-insured deposit institution; FDIC deposit insurance only protects against the failure of Wells Fargo Bank, N.A. Member FDIC