Internal Controls

WHAT ARE INTERNAL CONTROLS?

Internal controls are the mechanisms, rules, and procedures implemented by a company to ensure the integrity of financial and accounting information, promote accountability, and prevent fraud.

WHO IS RESPONSIBLE FOR INTERNAL CONTROLS?

We all play some part in ensuring the internal controls of operations are effective and efficient in reaching the University's goals and objectives. Faculty and staff have responsibility for ensuring that financial and operational controls are in place and functioning for a variety of areas. They are also responsible for reporting any breakdown in controls that may come to their attention. All university managers are responsible for planning, directing, staffing, implementing, and monitoring internal controls to ensure efficient and effective operations, reliable financial and operational reporting, and compliance with requirements.

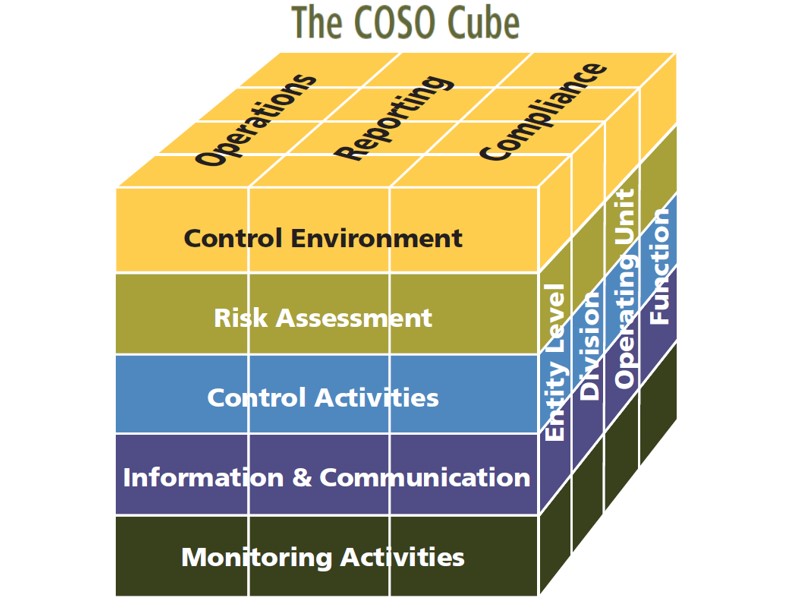

The COSO Cube

The Committee of Sponsoring Organizations of the Treadway Commission (COSO) Internal Controls cube is a diagram that shows the relationship among all parts of an internal control system. Together, they develop guidance documents to aid organizations with risk assessment, internal controls and fraud prevention. To view the COSO Internal Control – Integrated Framework.