Office of Financial Aid

The Office of Financial Aid is committed to assisting students in meeting the cost of a college education at FAMU.

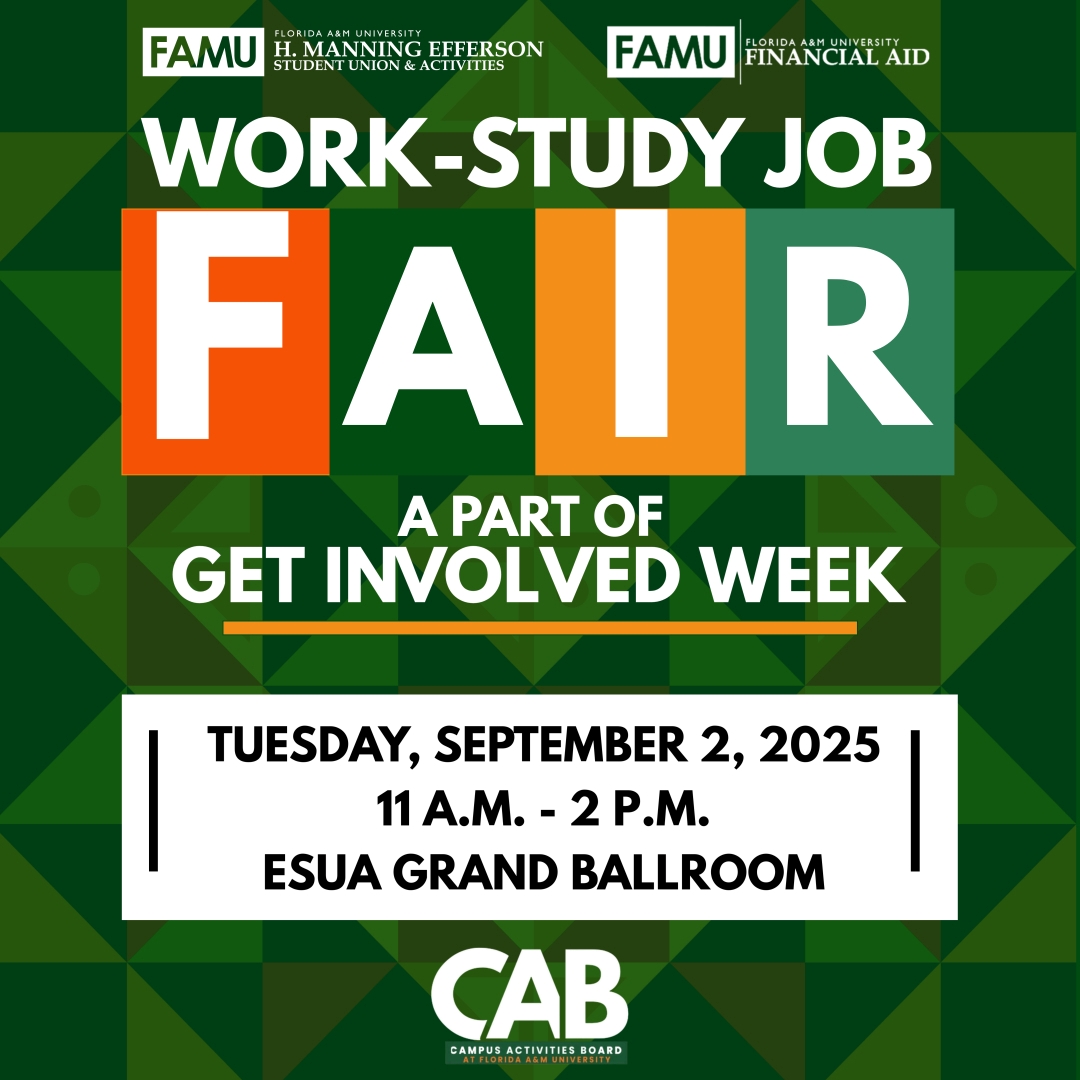

GET INVOLVED WEEK - WORK STUDY JOB FAIR 2025

SUMMER TRANSIENT WORKSHOP

The Office of Financial Aid will be hosting weekly Zoom meetings to provide information on the process for receiving financial aid as a transient student. These sessions are a great opportunity for students to ask questions, understand the requirements, and learn about the financial aid options available to help support their education during this time.

If you're interested in attending, please check your email or the school's financial aid website for the meeting schedule and access details. We encourage all transient students to participate and get the information they need!

Important Dates – Spring 2024

-

-

Monday, January 8, 2024

Classes BeginSunday, January 14, 2024

Spring Disbursements BeginMonday, January 15, 2024

MLK Holiday (No Classes)Monday, January 22, 2024

Tuition and Fees DeadlineMonday, March 11, 2024

Spring Break BeginsFriday, March 15, 2024

Spring Break EndsFriday, May 3, 2024

Spring Term Ends

Getting Started

The Office of Financial Aid is committed to making understanding and obtaining financial Aid easy for students and parents.

SFP is a cloud-based financial aid system that manages each student’s financial plan individually, automatically, and in real-time, providing visibility into their entire program, supporting better informed financial decisions and optimizing outcomes.

Every FAMU student has a dedicated Financial Aid Representative that can assist them with any financial aid needs or concerns. Find yours based on the first initial of your last name.

How Much Does It Cost To Attend FAMU?

Residency, tuition, housing, books, supplies, and other expenses are all factors that contribute to a student's cost of attendance (COA). Learn more about how much it costs to attend FAMU as an undergraduate, graduate, or law school student!

Learn more about how much it costs to attend FAMU as an undergraduate student, graduate student, or law student.

Financial aid is money provided by various agencies (federal, state and local governments, public and private postsecondary institutions, community organizations, and private corporations or individuals) to help students meet the costs of attending college.

Begin The Financial Aid Process

Learn more about the FAFSA, the FAMU Financial Aid Process, and how to keep track of your Financial Aid

The entire financial aid process starts with filing a Free Application for Federal Student Aid (FAFSA).

To complete your application and sign it electronically, you need a FSA ID. It can be used each year to apply for federal student aid and to access your records online.

If required to submit documentation verification, the U.S. Department of Education has announced that you must submit a copy of your 2020 IRS tax return transcript if you have not completed the IRS Data Retrieval Tool.

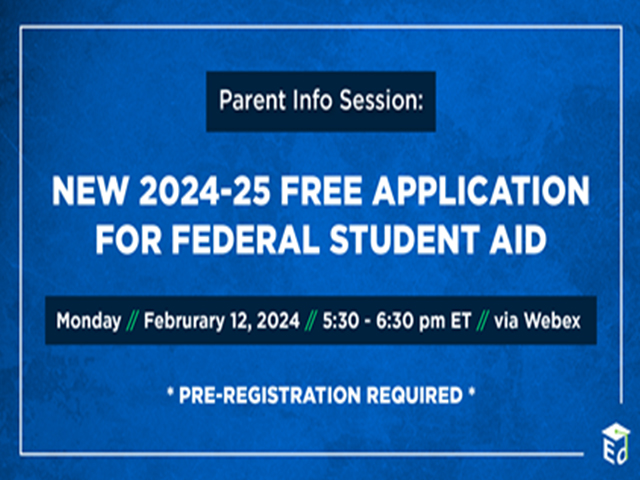

White House Initiative on HBCUs - FAFSA®️ Form Webinars for Parents, Guardians, and

Students

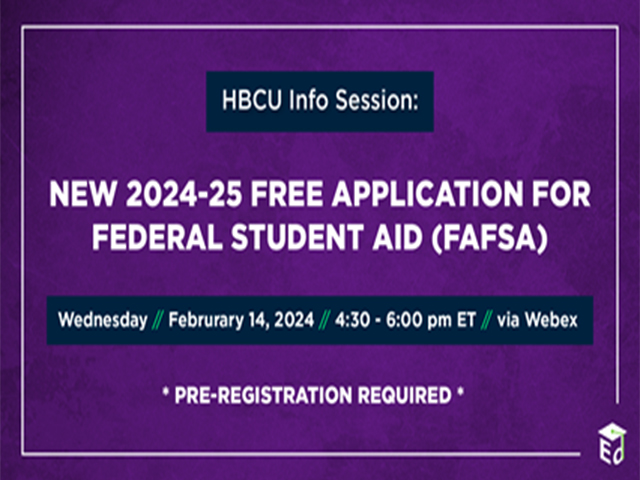

The White House Initiative on HBCUs invites you to join the Department of Education, Federal Student Aid for two webinars about the new 2024-25 Free Application for Federal Student Aid (FAFSA®️) Form.

HBCUs are consistent producers of academic and professional excellence that provide students from a range of backgrounds, especially low-income and first-generation students, the opportunity to obtain higher education. That’s why we’re hosting these workshops to help people better understand the new form.

2024–25 FAFSA®️ Form Webinars

Pre-Registration is Required

On Monday, February 12, our first webinar is a great opportunity for parents and guardians of current and prospective HBCU students to learn the best strategies to complete the new form, and changes to the financial aid process.

On Wednesday, February 14, the White House Initiative on HBCUs is inviting students to join the Department of Education, Federal Student Aid for a free webinar about the new 2024-25 Free Application for Federal Student Aid (FAFSA®️) Form. Learn best strategies to complete the new form, and changes to the financial aid process.

Information for Those Not Filing Taxes

-

For Non-Filer Dependent Students

Parents or students who did not file a 2021 tax return must provide a signed non-filer statement, certifying that you have not filed and are not required to file an income tax return, as well as a document listing the amount and sources of any income from that year. You must also submit a copy of your W-2 for any source of employment from that year.

Non-Filer Dependent Student Statement Form -

For Non-Filer Parents & Independent Students

Non-filers should be aware that the federal government now requires independent students and the parents of dependent students who filed a FAFSA to have the IRS verify if no tax return was filed. If this describes you, you must request a Verification of Non-Filing Letter from the IRS and submit the letter as part of your financial aid verification materials. Find more information on non-filing letters through the IRS

IRS Transcript Types

Waiting to Hear About Your Financial Aid?

Once you’ve filled out your FAFSA, you still have a few more steps before receiving your funds, and it is important to stay in touch with our office regarding your aid.

Check your financial aid tab in iRattler to find out if your file is complete or if you have outstanding requirements that will prevent the disbursement of your financial aid.

Check your FAMMail frequently for important financial aid information. The Office of Financial Aid uses email as the primary way to communicate with students.

If you can’t find the answers in our FAQs, you are welcome to contact your designated Financial Aid Representative or our office at (850) 599-3730.

Things To Know

More Information, Frequently Asked Questions (F.A.Qs), and Additional Resources

Here you will find resources that will provide you with pertinent financial aid information and assist you in the financial aid process.

Family Educational Rights and Privacy Act (FERPA)

The Family Educational Rights and Privacy Act (FERPA) is a Federal law that protects the privacy of student education records. The law applies to all schools that receive funds under an applicable program of the U.S. Department of Education.

FERPA gives parents certain rights with respect to their children’s educational records. These rights transfer to the student when he or she reaches the age of 18 or attends a school beyond the high school level. Students to whom the rights have transferred are “eligible students.”

Download the FERPA Policy (PDF) | Download the (FERPA) Student Consent Form (Word Doc.)

FSA ID REPLACES FEDERAL STUDENT AID PIN

For students, parents, or borrowers who have to log into a U.S. Department of Education website – like Free Application for Federal Student Aid (FAFSA) at studentaid.gov, the National Student Loan Data System (NSLDS®) at https://studentaid.gov/ , and log into your account. They will be asked to create new log-in credentials known as the FSA ID.

The FSA ID – a username and password – benefits you in four ways:

- It removes your personally identifiable information (PII), like your Social Security number, from your log-in credentials

- It creates a more secure and efficient way to verify your information when you log in to access your federal student aid information online

- It gives you the ability to easily update your personal information, like your phone number, e-mail address, or your name

- It allows you to easily retrieve your username and password by requesting a secure code be sent to your e-mail address or by answering challenge questions

Creating an FSA ID is simple and only takes a few minutes. You’ll have an opportunity to link your current Federal Student Aid PIN to your FSA ID, and even if you have forgotten your Federal Student Aid PIN or don’t have one, you can still create an FSA ID.

The final step in creating an FSA ID is to confirm your e-mail address. You will be sent a secure code to the e-mail address entered when you create your FSA ID. Once you retrieve the code from your e-mail account and enter it – confirming that your e-mail address is valid – you will be able to use this e-mail address instead of your username to login, making the log-in process EVEN simpler!

Remember, your federal student aid account information is valuable. Only the owner of the FSA ID should create and use the account, and you should never share your FSA ID.

For more information about the FSA ID, please visit StudentAid.gov/fsaid.

LOAN ORIGINATION FEES

Effective October 1, 2022, loan origination fee rates for the first disbursement of all loans made on or after October 1, 2022 and before October 1, 2023 are 1.057 percent for Direct Subsidized and Unsubsidized Loans and 4.228 percent for Direct Parent PLUS and Graduate PLUS Loans.

2023-2024 AWARDING PROCESS

The Office of Financial Aid will issue a financial award notification to First-Time-In-College students with completed files after January 1, 2023 and returning/transfer students by May 15, 2023. Awards for returning students will be available on iRattler. An e-mail will be sent to all returning students to remind them to view and accept their awards online. To help facilitate this plan, please respond promptly to all electronic correspondence from our office concerning your financial aid eligibility status. We encourage you to review your iRattler account periodically for updates.

After May 15, 2023 all awards will be made on a weekly basis and will be available for review on iRattler. Please remember you must accept or decline your loans.

With all the publicity about elite private colleges with $30,000‐a‐year price tags, many students and parents have misconceptions about how much it actually costs to attend college. One California study found that high school students overestimated the tuition cost of public universities by several thousand dollars! Such perceptions can have negative effects on students' and parents' ambitions

FICTION:My family can't afford the $20,000+ a year that it takes to go to college. |

FACT:Full‐time tuition at Florida public universities is only about $2,700 a year. |

A four‐year degree costs less than a new car and will pay for itself many times over

in graduates' higher incomes. At colleges, tuition is even lower, generally under

$1,750 a year. Living expenses are extra, but you'd have those even if you didn't

go to college!

FICTION:

|

FACT:

|

Florida resident tuition is set at about 25% of the cost of instruction. The state

pays 75%. In effect, every resident receives a 75% "scholarship." It's a bargain

you shouldn't miss!

FICTION:

|

FACT:

|

Most students in Florida receive some kind of financial aid. Those who qualify for

the Florida Bright Futures Scholarships are paid a flat cost per credit hour at an

eligible Florida postsecondary institution. The federal Hope Tax Credit also helps

some families get reimbursed for the first two years of college. Many sources of need‐based

aid are also available. On or off‐campus jobs and low‐interest loans can help pay

living expenses for some low and middle‐income students. Many students with few resources

manage to work their way through college. Before saying you can't afford it, call

a college financial aid office to discuss your options!

FAMU Office of Financial Aid : (850) 599-3730

FICTION:

|

FACT:

|

That is, they represent an investment that will pay for itself. A student who graduates with $25,000 in student loans and gets a job paying $30,000 a year will have a higher standard of living than a student who doesn't attend college and has a job paying $20,000 a year. Many families qualify for subsidized loans with low interest and flexible repayment plans. Student loans are also easier to get than many other loans.

FICTION:

|

FACT:

|

Many of the most expensive private colleges also have the most generous financial aid programs for low‐income families. Even middle‐income students who attend private colleges often receive "discounts" from full tuition. Getting into selective private colleges isn't easy, but qualified students shouldn't shy away for financial reasons. Colleges want students with diverse backgrounds and may make generous financial aid offers to low‐income students with good academic credentials. In addition, Florida offers tuition assistance grants to resident students who attend in‐state private colleges. Some families find out that when financial aid offers are considered, a seemingly "pricey" private college is less expensive than a public one.

The Financial Aid Shopping Sheet is a consumer tool designed by the U.S. Department of Education to notify students about costs and financial aid. Florida A&M University offers a student specific financial aid shopping sheet to all undergraduate, graduate, and professional students, regardless of degree level.

Once a student is accepted and has been awarded aid for a particular academic year, the Financial Aid Shopping Sheet will be available in the student’s iRattler for review.

Steps to Access your personal Financial Aid Shopping Sheet

- Login to iRattler

- Select iRattler Campus Solutions

- Under Self Service, select Student Center

- Select View Financial Aid and choose the appropriate aid year

- Select Shopping Sheet

To review a template of the Financial Aid Federal Shopping Sheet, click here.

Unusual Enrollment History

The U.S. Department of Education has established new regulations to prevent fraud and abuse in the Federal Pell Grant Program and Federal Direct Loan Program by identifying students with unusual enrollment histories. Some students who have an unusual enrollment history (UEH) have legitimate reasons for their enrollment at multiple institutions. However, such an enrollment history requires our office to review your file in order to determine future federal financial aid eligibility. If selected by the Department of Education (via the FAFSA), this must be resolved before you will receive financial aid.

Definition of Unusual Enrollment History

The specific pattern the Department of Education uses to select students includes those students who have received a Federal Pell Grant or a Federal Direct Loan (not including a Direct Consolidation Loan or parent PLUS Loan) at multiple institutions during the past three academic years. Once the Department of Education indicates that a student has an unusual enrollment history, the Financial Aid office must then take action and review the academic history prior to determining federal financial aid eligibility for that student.

What Will Be Required of You

If selected, our office will notify you of what is required. We will check your financial aid history at previous institutions that you attended during the previous three years. You are required to have received academic credit at any institution you received the Federal Pell Grant and/or Federal Direct Loan (not including a Direct Consolidation Loan or parent PLUS Loan) while attending during those relevant academic years. You need to ensure that we have received all official transcripts for schools previously attended. These records were required at the time of admission and must be on file with the Registrar's Office for your financial aid review. Our office will verify the academic credit was received at each institution during the relevant years. If so, we will notify you that you have satisfied this requirement. If you failed to receive academic credit at any institution you received a Federal Pell Grant and/or Federal Direct Loan (not including a Direct Consolidation Loan or parent PLUS Loan) during the relevant award years, your federal financial aid will be denied and you will be notified.We hope that the resources found on this website have been helpful in helping you finance your education at the Florida A&M University. Though we attempt to make the process simple and allow you to get most of your questions resolved easily with our office, there may be times before, during, or after your FAMU career that you will want to research and contact our financial aid partners.

- Admissions

- Housing

- Registrar Office

- Student Accounts

- 360 Degrees of Financial Literacy

- U.S. Department of Education

- Florida Department of Education

- FDIC Consumer News

The 2014 Florida Legislature created funding for the Honorably Discharged Graduate Assistance Program (HDGAP) as a supplemental need-based veteran educational benefit. Funds are to be used to assist in the payment of living expenses during holiday and semester breaks for active duty and honorably discharged members of the Armed Forces who served on or after September 11, 2001.

The appropriation will provide need-based veterans educational benefits in the form of supplemental living expenses during holiday and semester breaks. This program is for undergraduate AND graduate students.

To be eligible, students must meet all of the requirements below:

- Be an active duty or honorably discharged member of the Armed Forces who served on or after September 11, 2001;

- Be a Florida resident;

- Be enrolled in a degree seeking program of study (undergraduate or graduate);

- Complete an error-free 2020-2021 Free Application for Federal Student Aid (FAFSA);

- Have sufficient unmet need as defined by the FAFSA;

- Be enrolled in the Fall semester 2023;

- Be registered for the Spring 2024 semester;

- Complete all required applications/documents by the November 1st deadline.

Eligible students may receive up to 20 days at $50.00 per day in benefits ($1,000). However, the actual amount will be based on the number of eligible students. The actual amount may be significantly lower.

Funding is not guaranteed and is determined by the Florida Legislature and the Florida Office of Student Financial Assistance. All funding will be disbursed during the Fall semester.

For additional questions or concerns, please call the Office of Financial Aid at (850) 599-3730.

Hours of Operation:

Monday............................9:00 a.m. - 4:00 p.m.

Tuesday –Thursday......8:30 a.m. - 4:00 p.m.

Friday............................... 8:30 a.m. - 12:00 p.m.

Saturday – Sunday........Closed

The Higher Education Opportunity Act of 2008 (HEOA) requires that postsecondary institutions participating in federal student aid programs make certain disclosures to enrolled and prospective students, parents of students, and employees in their decision-making regarding education or employment at the Florida Agricultural and Mechanical University. In compliance with federal law, the following information is made available to guide you in your decision-making process. To obtain more information, or to request a paper copy of any materials, please call or email the appropriate office of visit the indicated websites.

Under Florida Law, email addresses are public records. If you do not want your email address released in response to a public records request, do not send electronic mail to the University. Instead, contact the specific office or individual by phone or in writing. Types of Financial Aid emails include:

- • Financial Aid Awards and Revised Awards

- • Financial Aid Follow-Up Letters

- • Direct Loans Correspondence (e.g., Entrance Counseling)

- • Satisfactory Academic Progress Notifications

- • Work Study Award Notification and Procedures

- • Verification Notifications

- • Requests for Additional Documentation

- • Financial Aid Priority Dates and Deadlines